Mileage Reimbursement 2024 Canada Tax. Rates are reviewed on a quarterly basis. The updated cra mileage rates for 2024 carry significant implications for both business owners and employees in canada.

Understanding and effectively applying these rates. If the amount of the travel.

Mileage Reimbursement 2024 Canada Tax Images References :

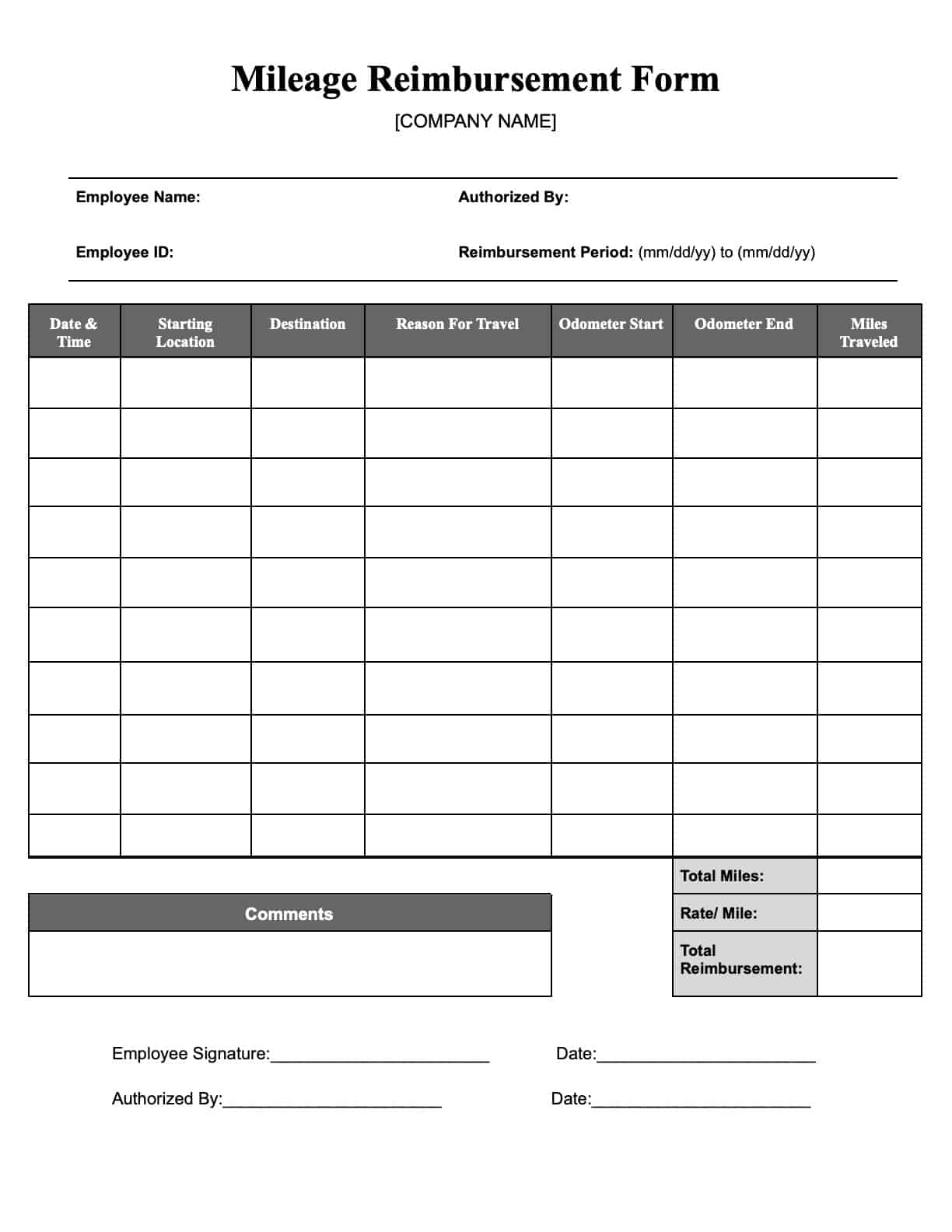

Source: winniqnorrie.pages.dev

Source: winniqnorrie.pages.dev

Canada Mileage Reimbursement Rate 2024 Leann Myrilla, You may provide a motor vehicle to your employee to use in performing their duties of office or employment that is not an automobile.

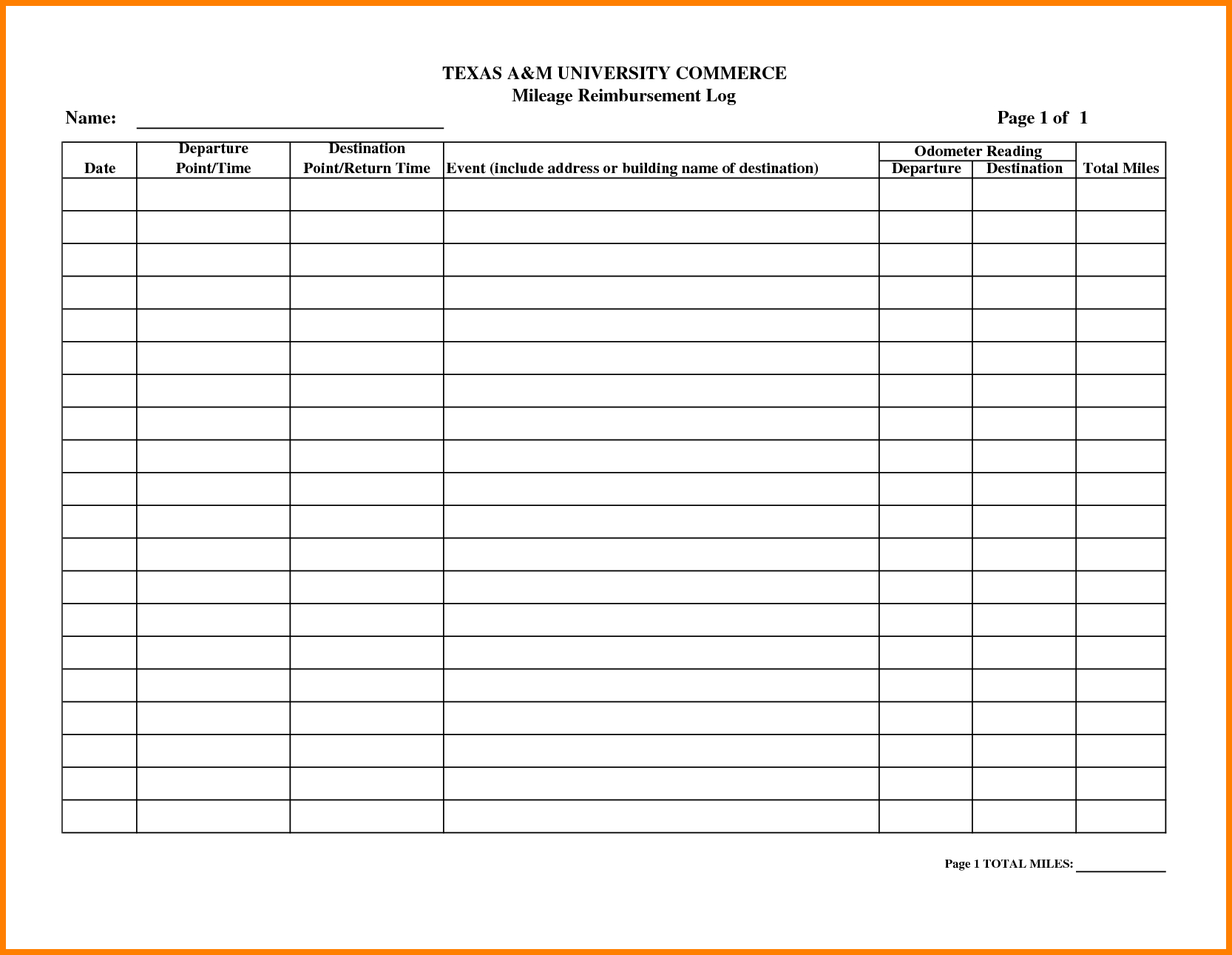

Source: charmainewkarla.pages.dev

Source: charmainewkarla.pages.dev

Mileage Reimbursement 2024 Canada Tax Cari Rosanna, Generally, the benefit from personal driving of.

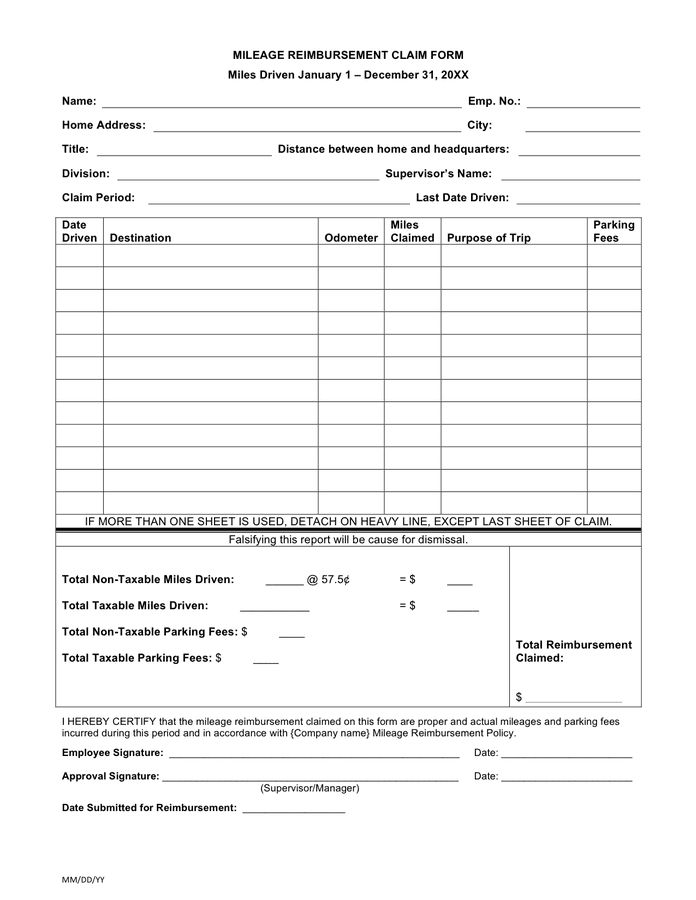

Source: charmainewkarla.pages.dev

Source: charmainewkarla.pages.dev

Mileage Reimbursement 2024 Canada Tax Cari Rosanna, The cra mileage rate for 2024 is:

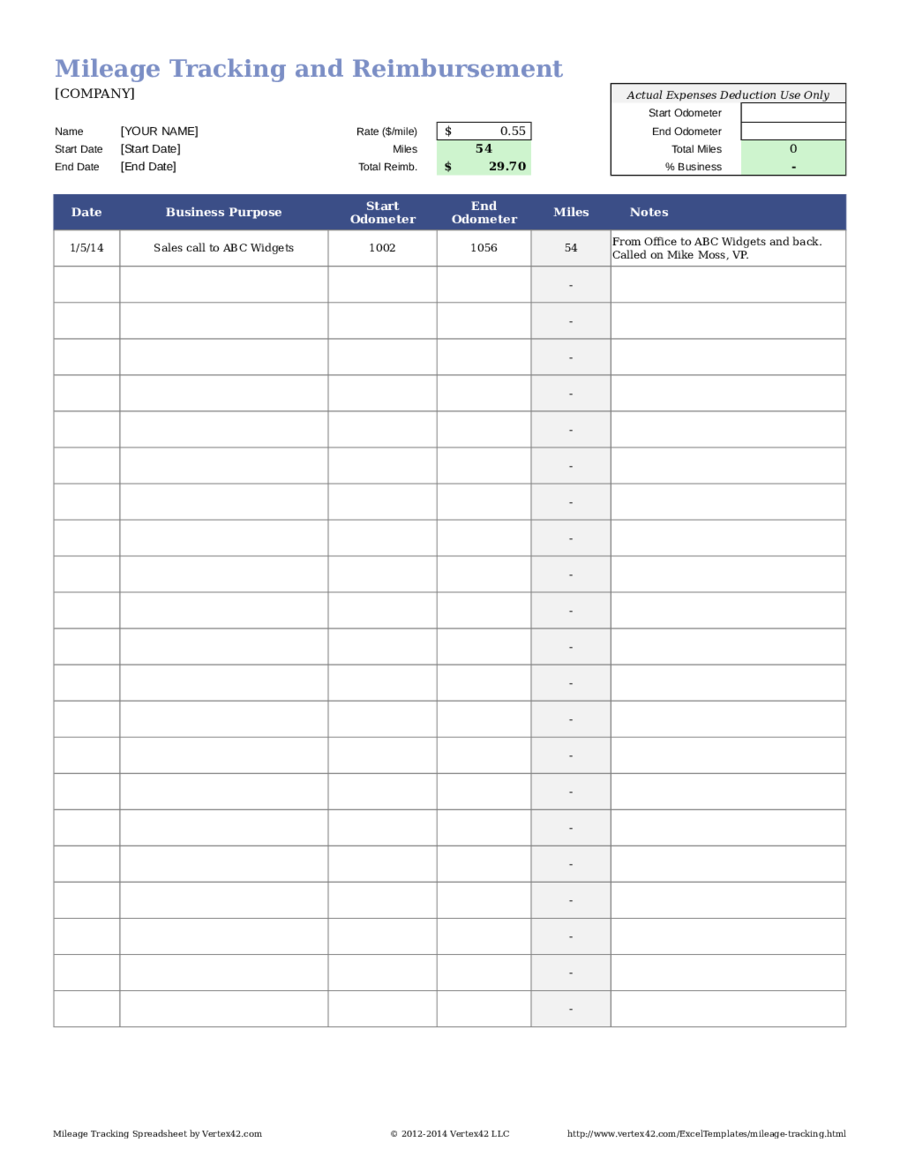

Source: samarawlydia.pages.dev

Source: samarawlydia.pages.dev

Canada Mileage Reimbursement 2024 Olive Ashleigh, July 1, 2024 the kilometric rates (payable in cents per kilometre) below are payable in canadian funds only.

Source: diannaynicole-zgs.pages.dev

Source: diannaynicole-zgs.pages.dev

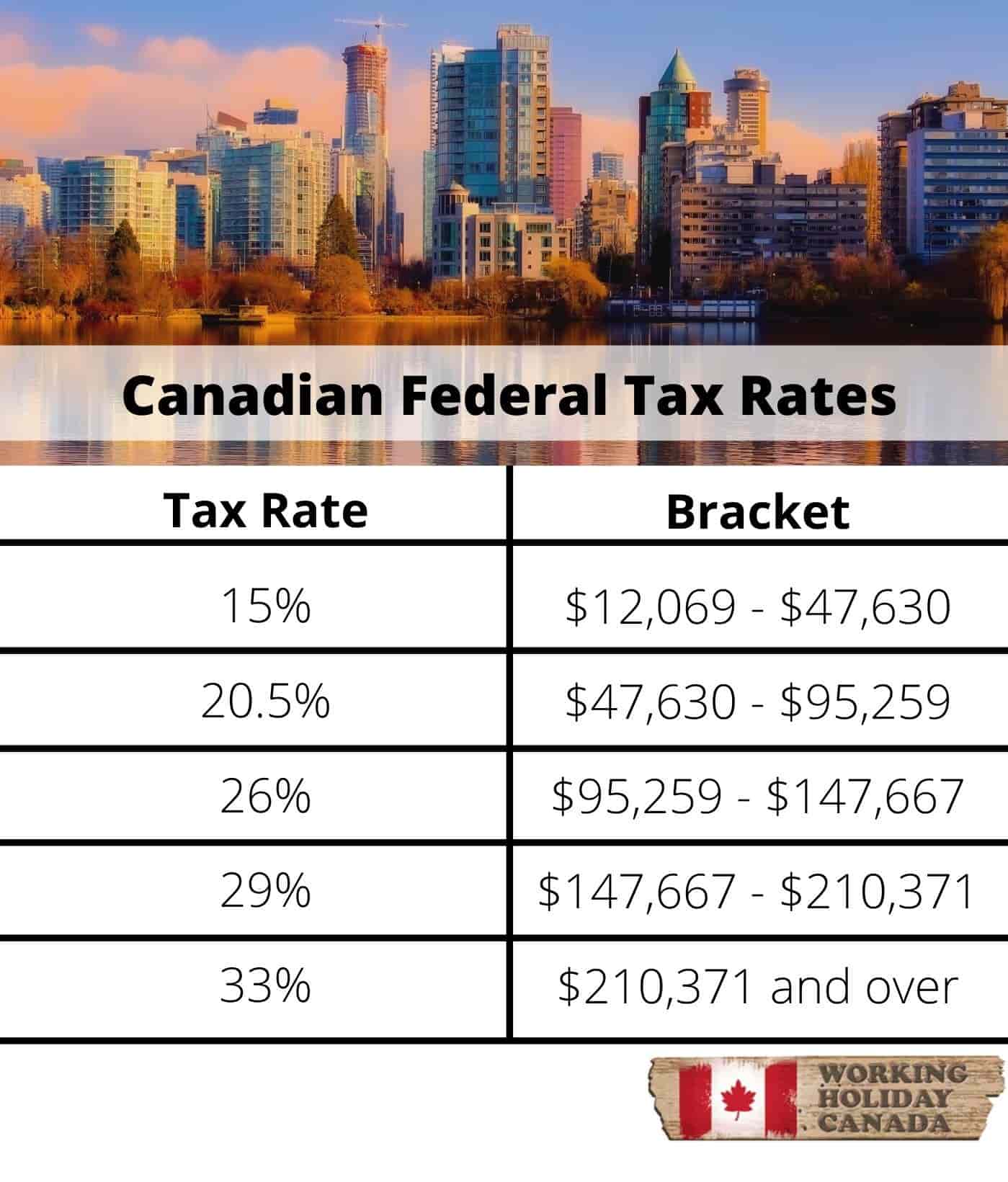

2024 Tax Rates And Brackets Canada Free Johna Babette, As of 2024, the cra will give back 70¢ per kilometre for the first 5,000 kilometres driven and 64¢ per kilometre after that.

Source: alfiqchandal.pages.dev

Source: alfiqchandal.pages.dev

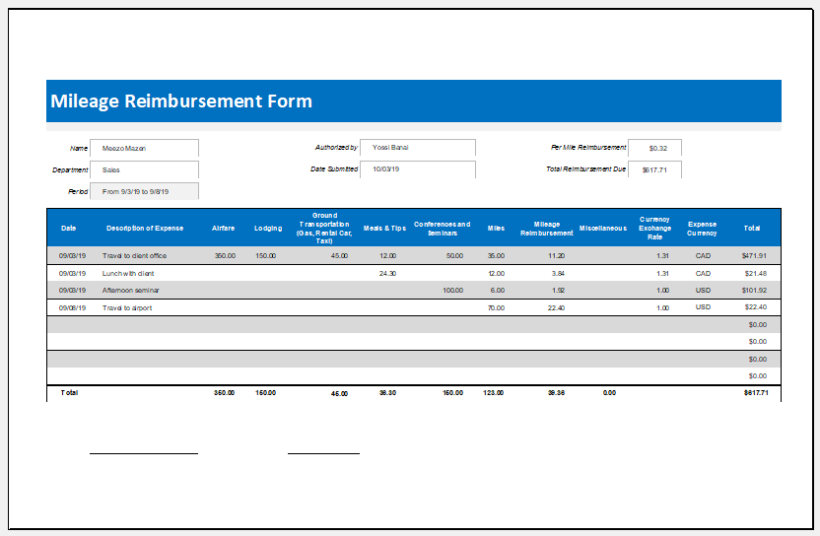

Mileage Reimbursement 2024 Canada Dorri Germana, Generally, the cra considers an allowance or a reimbursement reasonable if all conditions are met:

Source: belbjoella.pages.dev

Source: belbjoella.pages.dev

Reimbursement For Mileage 2024 Canada Celia Darelle, The following changes to limits and rates will take effect as of january 1, 2024:

Source: sabazilvia.pages.dev

Source: sabazilvia.pages.dev

Mileage Rate For 2024 Taxes Canada Kenna Shirlene, If the amount of the travel.

Source: haliejessamine.pages.dev

Source: haliejessamine.pages.dev

Revenue Canada Mileage Rate 2024 Kelli Melissa, The 2024 business mileage charges released by the cra body enables employees to claim reimbursement at 70 cents for the first 5000 kilometers driven in.

Source: eloisaqeleanora.pages.dev

Source: eloisaqeleanora.pages.dev

Mileage Reimbursement Canada 2024 Jade Rianon, When you do get your reimbursements, make sure they are included in your employment contract and follow the cra automobile allowance (aka mileage) rates for 2024.